Financing Climate Action

Financial resources and sound investments are needed to address climate change, to both reduce emissions, promote adaptation to the impacts that are already occurring, and to build resilience. The benefits that flow from these investments, however, dramatically outweigh any upfront costs.

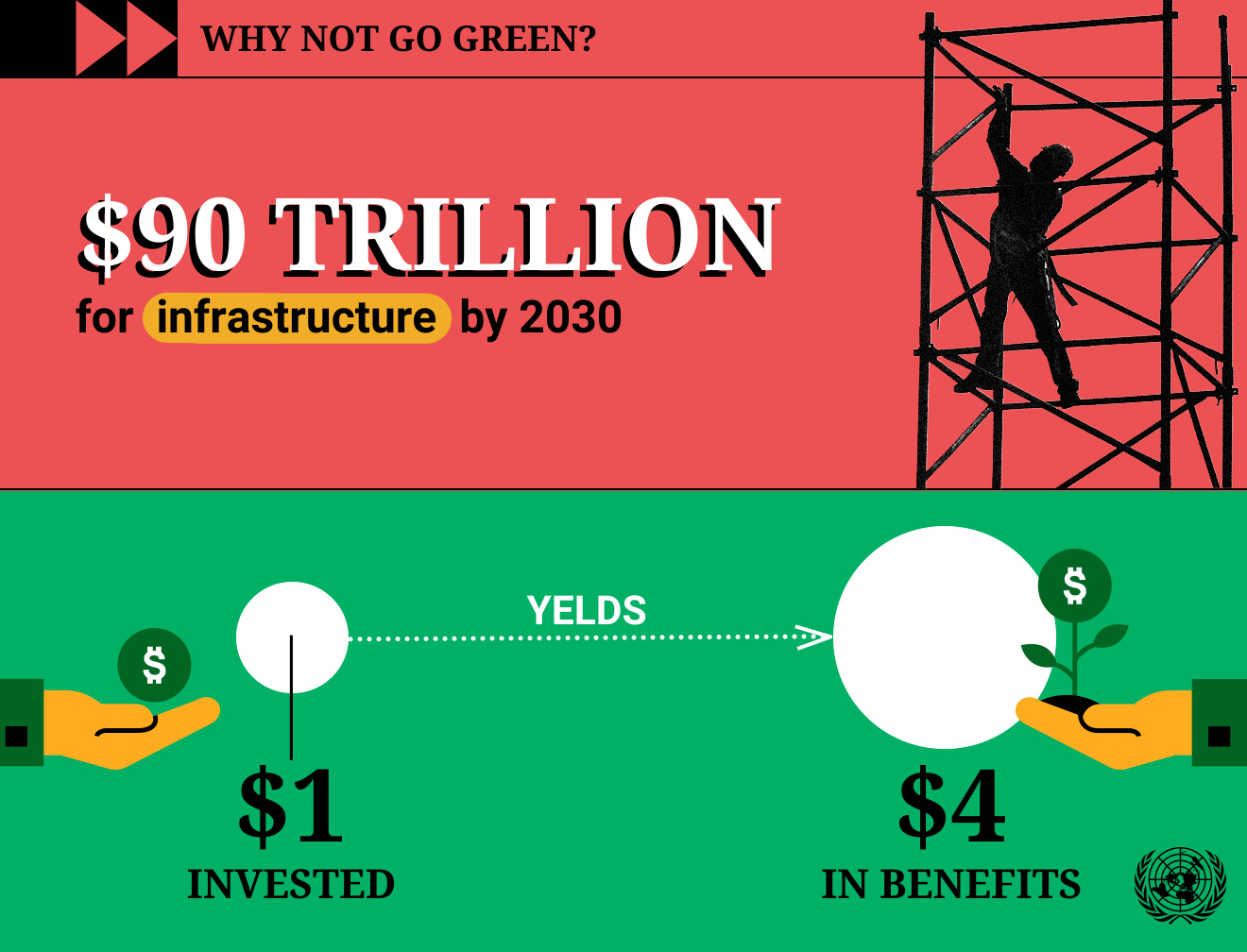

Studies and reports conducted before the COVID-19 pandemic showed that investments in climate action would go far to build a sustainable economy. According to October 2019 data from the World Bank , the world will need to make significant investment in infrastructure over the next 15 years –around US$90 trillion by 2030. But it can recoup those investments. Transitioning to a green economy, it found, can unlock new economic opportunities and jobs. An investment of US$1, on average, yields US$4 in benefits.

And the New Climate Economy Report, issued in 2018, found that bold climate action could yield a direct economic gain of US$26 trillion through to 2030 compared with business-as-usual—a conservative estimate, it said.

COVID-19 has not stopped climate change, and although the pandemic did produce a drop in emissions, the drop was temporary and emissions have climbed back to about where they were before the pandemic—back a path that would lead to global temperature increases far in excess of the Paris Agreement goal of 1.5°C, and which would cause far great devastating impacts.

Investment decisions now will determine whether we create or destroy wealth and potential paths to prosperity. It is increasingly clear that the world cannot afford to burn all of its fossil fuel reserves if we are to succeed in limiting climate change to sustainable, livable, levels. The long-term economic reality is that only a fraction of proven fossil fuel reserves can be burned if we are to keep temperature rise to 1.5°C.

This transition will require policies that steer nations towards carbon neutrality well before 2050. That is why UN Secretary-General António Guterres has set six priority areas for climate action during the COVID-19 recovery phase including: investing in decent jobs; no bail-outs for polluting companies; abandoning fossil fuel subsidies; ending investment in and construction of coal-fired power plants; taking climate risks and opportunities into account in all financial and policy decisions; increasing international cooperation; and ensuring a just transition that leaves nobody behind.

This raises the question of assets that will be abandoned well before their intended date of retirement and will not produce the expected returns. Already, coal mines are being closed as the price of coal becomes increasingly more expensive compared with renewable energy sources. Replacing the costliest 500 gigawatts of coal capacity with solar and wind would cut annual costs by up to US$23 billion per year and yield a stimulus worth US$940 billion, or around 1 per cent of global gross domestic product.

Paris Agreement aims to mobilize finance for climate

Countries recognized the need for specific climate financing in the Paris Agreement which calls for “making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development. ”

In addition to reducing emissions, making infrastructure more resilient avoids costly repairs and minimizes the wide-ranging consequences of natural disasters on the livelihoods and well-being of people, particularly the most vulnerable, as well as on businesses and economies. And a shift to low-carbon, resilient economies could create over 65 million net new jobs globally out to 2030.

Efforts under the Paris Agreement are guided by its aim of making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development. Assessing progress in provision and mobilization of support is also part of the global stock take under the Agreement. The Paris Agreement also places emphasis on the transparency and enhanced predictability of financial support.

The Agreement itself calls for implementation that reflects “equity and the principle of common but differentiated responsibilities and respective capabilities, in the light of different national circumstances.”

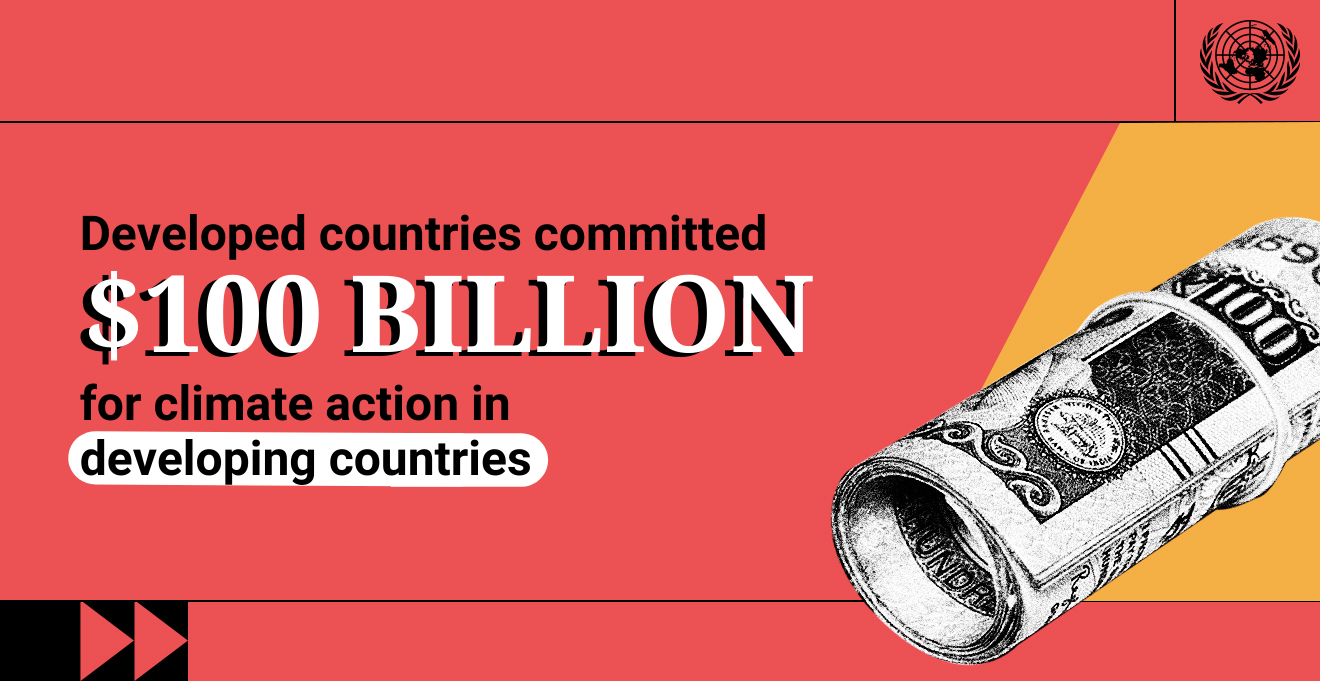

Responding to the climate crisis requires collective action from all countries, cities, financial actors, businesses, and private citizens. Among these concerted efforts, developed countries committed to jointly mobilize US$100 billion per year by 2020, from a variety of sources, to address the pressing mitigation and adaptation needs of developing countries.

Governments also agreed that a major share of new multilateral, multi-billion dollar funding should be channeled through the Green Climate Fund. At the Fund's first replenishment conference in October 2019, leaders demonstrated strong confidence in GCF's ability to support developing countries to design and deliver ambitious climate action plans known as Nationally Determined Contributions (NDCs). The Fund also has an essential mandate to maintain an even balance between mitigation and adaptation in its portfolio, and to engage the private sector through its Private Sector Facility to mobilize private finance toward low-carbon, resilient investments.

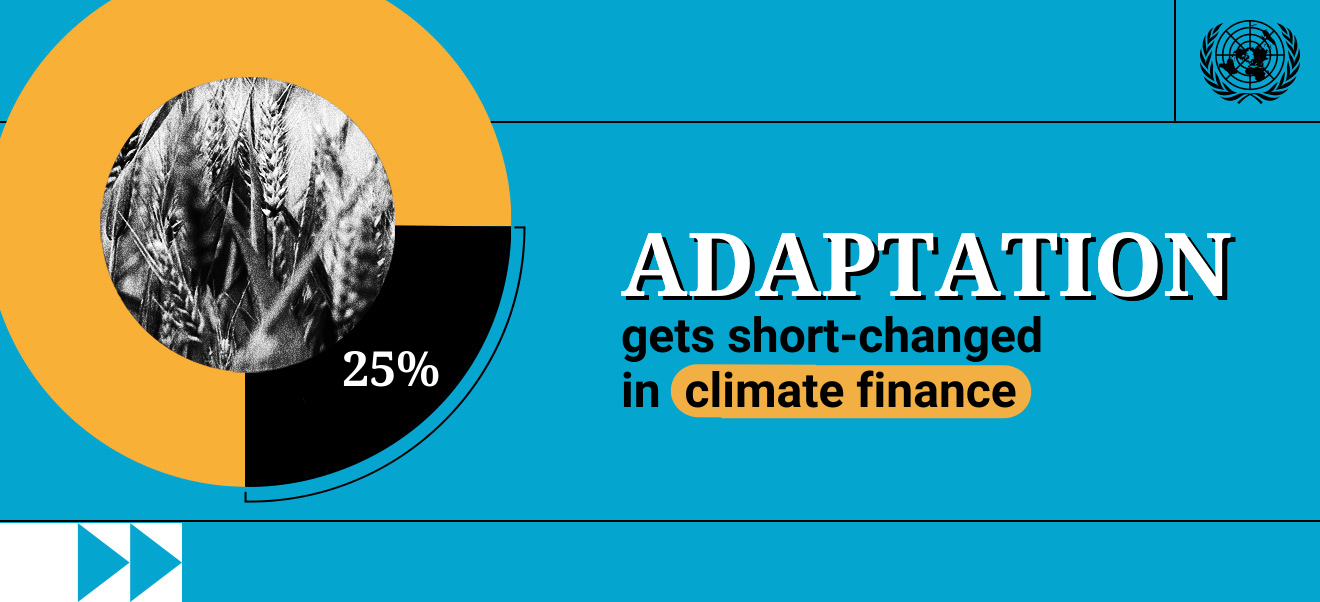

But that even balance has been difficult to achieve so far. Finance for adaptation continues to make up only a small percentage of climate finance overall, about 20 percent. The Climate Policy Imitative noted in its 2019 Climate Finance Landscape report that the vast majority of the finance that is tracked continues to flow toward activities for mitigation. Furthermore, adaptation represented only 0.1% of private flows tracked in the Landscape, and also represents a small percentage of the GCF’s private sector portfolio.

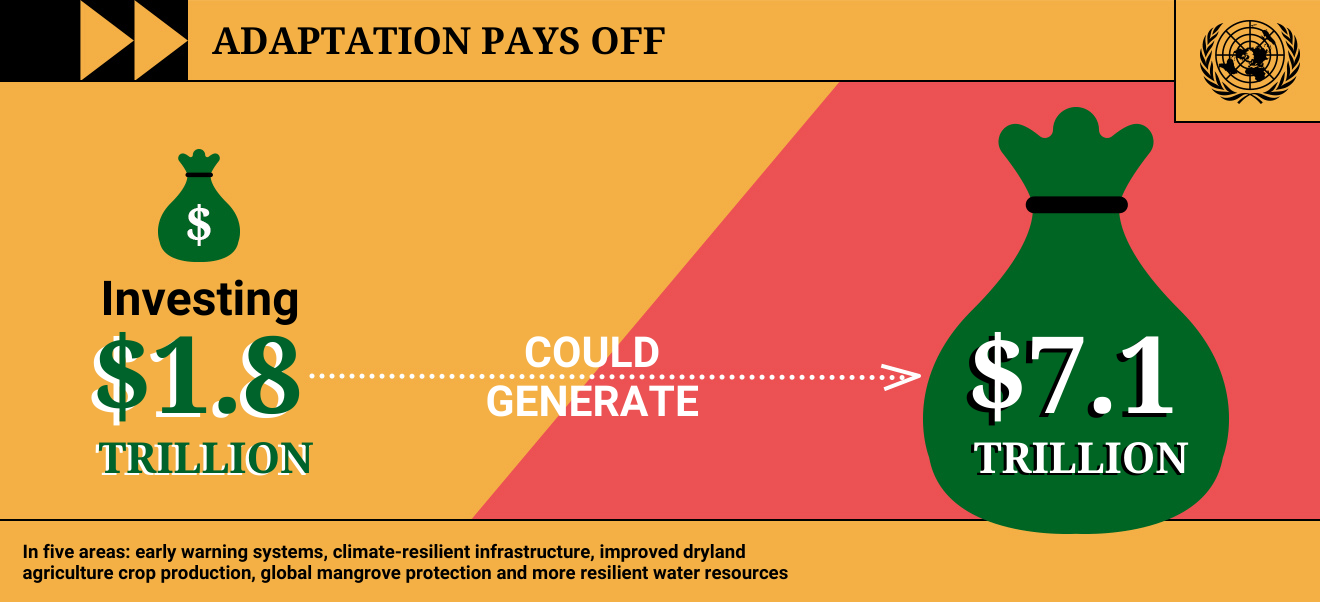

These trends are despite evidence of the value of adaptation. The Global Commission on Adaptation, for instance, estimated that investing US$1.8 trillion from 2020 to 2030 could generate US$7.1 trillion in total net benefits in five areas – early warning systems, climate-resilient infrastructure, improved dryland agriculture crop production, global mangrove protection and more resilient water resources.

To ensure decisive steps toward decarbonization and unlocking investments in adaptation and resilience, multilateral development banks (MDBs) and development finance institutions (DFIs) need to take urgent measures to, besides setting climate finance targets, align their whole portfolios with the Paris Agreement and disclose their climate risk.

A surge of interest from the private sector

There has been a surge in interest from companies and some major investors in adopting sustainable business plans that are compatible with a 1.5°C future, as decision-makers recognize the vast growth opportunities ahead in the global transition to a decarbonized economy by 2050. However, much wider progress is needed, and the journey of companies and investors - in aggregate - is only in its early stages.

Major pensions funds and investments firms, who acknowledge that their portfolios are now more aligned with a 3.5°C future, are now starting to move at scale by working with the asset managers and companies in their portfolios to decarbonize and align with net zero targets.

Efforts to engage the private sector to in meeting the Paris goals are gaining momentum. One initiative launched during the 2019 UN Climate Action Summit, the UN-convened Net Zero Asset Owner Alliance, presently includes members that hold approximately US$5 trillion assets under management and demonstrates that the number of financial actors willing to “walk the talk” is increasing. The Alliance now has 29 members, including pension funds, insurance companies, and sovereign wealth funds, and is working on substantial methodologies to align portfolios with net zero Paris targets.

Decisive steps are also needed from investors to use their voting power in the companies in their portfolios, by systematically supporting climate resolutions in shareholders’ meetings to accelerate the decarbonization process.

Investors should also add a “do no harm” test to ensure that investments will indeed contribute to climate objectives, like the European Union proposed in its recent recovery plan.

Still underestimating the risks

Many investors, as well as banks and companies, continue to underestimate the risks of climate change and are still making short-sighted decisions to expand investment into carbon-intensive assets. One of the primary ways to break the link between greenhouse gas emissions and economic activity is to change the energy supply mix, transitioning from fossil fuels to renewable sources of energy.

Identifying and managing climate risks and opportunities remains a crucial undertaking to advance low-carbon, climate resilient growth. Climate risk disclosure and reporting frameworks, such as the Task Force for Climate-Related Disclosures (TCFD) provide a sound framework for financial actors and real economy companies to address climate risks and benefit from the opportunities that the transition to low-carbon, climate resilient economies bring.

A new financial system to confront climate risks

According to UN Special Envoy on Climate Finance Mark Carney, who, until recently, was the Governor of the Bank of England, a new and sustainable financial system is slowly being built that will provide funding for the initiatives and innovations of the private sector, which in turn has the potential to amplify the effectiveness of the climate policies of governments. This includes the growing effort to include climate risks in decision making, such as the TFCD.

“But the task is large, the window of opportunity is short, and the risks are existential,” he said, adding that “like virtually everything else in the response to climate change, the development of this new sustainable finance is not moving fast enough for the world to reach net zero.”

While frameworks such as TCFD remain voluntary, it will be essential to level the playing field through substantive regulation on climate risks disclosure and reporting, in a way that ensures that the differences in capacity among countries are well acknowledged and addressed.

The challenge remains to avoid the proliferation of standards, and encourage financial authorities and regulators to work together to ensure coherent, cohesive regulation. The Network for Greening the Financial System brings together Central Banks, financial regulators and authorities toward enhancing the role of the financial system to manage risks and mobilize capital for low-carbon, resilient investment.

Losses due to stranded assets can imperil financial stability. If estimates are even approximately correct, Carney said, “it would render the vast majority of reserves ‘stranded’ – oil, gas and coal that will be literally unburnable without expensive carbon capture technology, which itself alters fossil fuel economics.”

Why finance climate action?

Climate action requires significant investment, but its value is immense: a livable climate. Countries around the world are showing how climate finance can improve people’s lives and prospects for the planet.

Climate finance: Time to deliver

Reaching net zero requires making good on the $100 billion annual climate finance commitment – at a minimum. An independent expert report tracks where the money has to come from to meet climate goals.

Mafalda Duarte: Climate finance catalyses change

In a recent interview, Mafalda Duarte, CEO of the Climate Investment Funds, spoke about how public climate finance catalyses change and why successful climate action depends fundamentally on social inclusion.

Mark Carney: Investing in net-zero climate solutions creates value and rewards

In a recent interview, UN Special Envoy on Climate Action and Finance Mark Carney spoke about how private finance is increasingly aligned behind achieving net-zero greenhouse gas emissions. He underlined that people everywhere should keep up the pressure in calling for climate action.